New 2013 Angola Cement Market Report Update: CW Research analysts expect cement demand boom to continue through 2017

CW Group, a leading global advisory, research and business intelligence boutique with a recognized expertise and thought-leadership in the global cement sector, announces the availability of its 2013 Angola Cement Market Report Update. Structured as a decision-support tool for industry executives and investors, the report provides a detailed analysis of the cement and construction materials markets in Angola through 2017.

Angola cement industry ÔÇô crackling growth

ÔÇ£The Angolan economy took off once again in 2012 and is expected to deliver strong growth over the medium term, with a slowdown expected from 2017,ÔÇØ said Claudia Stefanoiu, Senior Analyst at CW Research, the business analysis team of the CW Group. ÔÇ£The coverage update report is ly as the Angola cement market stands at an important inflection point in its growth trajectory; competition is intensifying and the sector is evolving rapidly, with new entrants and new challenges. More broadly, CW Research keeps a close watch on a number of cement markets and strategic areas, for which we provide unrivaled market insights and business decision support,ÔÇØ Claudia Stefanoiu added.

In 2012, Angola's economy expanded by 8.4 percent. On the back of oil price recovery and production increase, Angola experienced last year surplus for its fiscal and external accounts, with inflation falling to a two-decade low 9 percent. The local economy is set to maintain a sustained growth pace, with real GDP projected to increase 6.2 percent in 2013 and 7.3 percent in 2014.

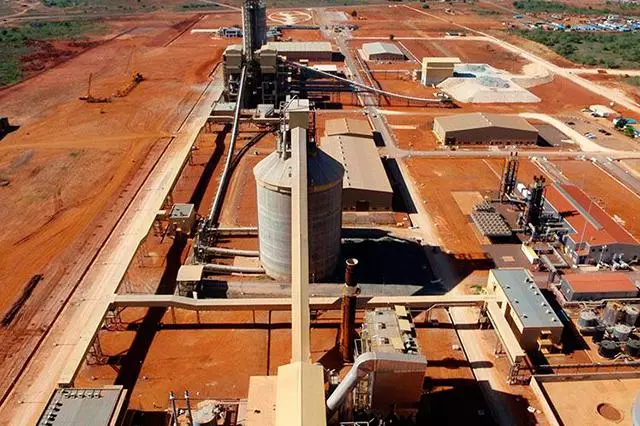

The cement industry plays a strategic role in the economic prosperity of Angola. The reconstruction program and the development of cities and industrial centers are key drivers in generating investment projects, requiring large quantities of cement. The sector was long dominated by Nova Cimangola in Luanda as well as by Secil Lobito in the southwestern port city of Lobito. For decades, only limited investment was made in their wet kiln production units and they faced persistent operating problems. Consequently, Angola was one of the largest cement importers in Africa, with Chinese imports dominating the market under a state-controlled licensing program.

Local cement majors & domestic

Among the four cement companies present in Angola today ÔÇô China Investment Fund and Cimenfort Industrial joining the incumbents ÔÇô, only one benefits from state-of-the-art kilns, able to produce clinker domestically in competitive parameters. The companies are focusing on ramping-up capacity or expansion projects.

Additionally, there are three new cement plant construction projects expecting to be commissioned by the end of 2017, which will propel total cement production capacity forward threefold, on condition that all announced projects are implemented at the currently proposed specifications. As cement companies expand and modernize, domestic cement capacity is likely to become sufficient starting 2016. However, cheaper Chinese imports are not easy to curb.

In recent years, Angolan cement industry has mirrored the impressive evolution of the economy and of the construction sector, expanding over 20 percent per year on average between 2005 and 2011. However, due to multiple factors, the growth stalled out in 2012 and landed in single-digit percent YoY increase. Even so, domestic production fell far short of the total national 2012 cement demand, with the balance supplied from the Far East.

Exciting But reason for concern

One of Angola's main areas of concern is its low level of public investment. The country's total investment is around 13 percent of GDP, well below the 24 percent average for Sub-Saharan Africa. Public investment accounts for about 10 percent of GDP, while private accounts for only 3 percent. However, public investment has been encouraged in recent years, with the indicator expanding in nominal terms by 15 percent in 2011 and 29 percent in 2012. The 2013 budget reflects an even steeper increase, with capital expenditures boosted by 60 percent.

The outlook nonetheless, barring major upsets, looks bright for the Angola cement sector demand. CW Group expects growth to continue in the next 4-5 years for the sector, picking up steam in 2013, exceeding 8 million tons in cement demand by 2017. The ÔÇ£land grabÔÇØ is in full swing in the sector, but we remind outsiders that geo-political risk is alive and well in Sub-Sahara and Angola is a challenging market for outsiders to conduct business in.